The 10-Minute Rule for Pvm Accounting

The 10-Minute Rule for Pvm Accounting

Blog Article

The smart Trick of Pvm Accounting That Nobody is Talking About

Table of ContentsExamine This Report about Pvm AccountingThe Best Guide To Pvm AccountingPvm Accounting Can Be Fun For AnyoneThe Main Principles Of Pvm Accounting Pvm Accounting Can Be Fun For AnyoneFascination About Pvm Accounting

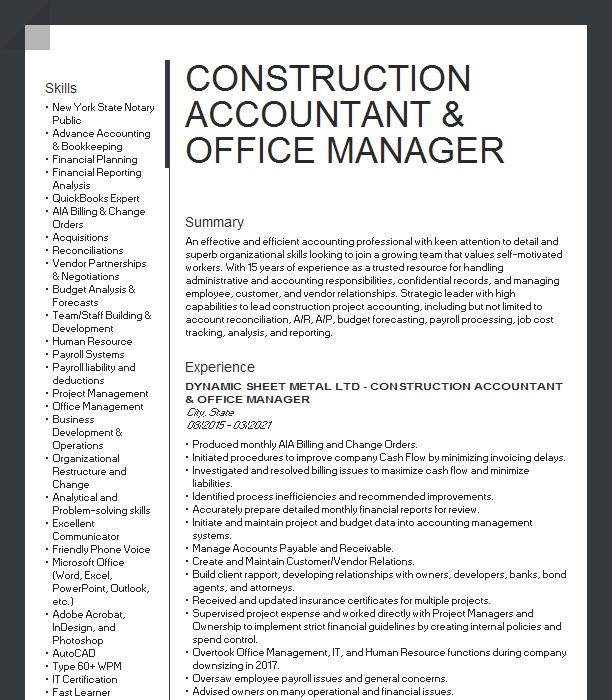

Make sure that the audit procedure abides with the regulation. Apply required construction bookkeeping criteria and procedures to the recording and reporting of construction activity.Understand and preserve typical expense codes in the accounting system. Communicate with various financing companies (i.e. Title Business, Escrow Business) pertaining to the pay application process and demands required for settlement. Take care of lien waiver dispensation and collection - https://moz.com/community/q/user/pvmaccount1ng. Display and resolve bank issues consisting of charge anomalies and inspect differences. Aid with implementing and preserving interior financial controls and procedures.

The above statements are meant to explain the basic nature and level of work being done by people assigned to this classification. They are not to be construed as an exhaustive list of responsibilities, duties, and abilities needed. Workers may be required to execute tasks outside of their normal duties every now and then, as required.

Not known Details About Pvm Accounting

Accel is looking for a Construction Accountant for the Chicago Office. The Construction Accountant does a selection of accounting, insurance compliance, and project administration.

Principal duties consist of, yet are not limited to, dealing with all accounting functions of the business in a prompt and accurate way and supplying records and timetables to the firm's certified public accountant Company in the preparation of all financial statements. Guarantees that all bookkeeping procedures and functions are taken care of properly. In charge of all financial documents, pay-roll, financial and daily procedure of the accounting function.

Prepares bi-weekly test equilibrium reports. Functions with Task Managers to prepare and publish all monthly billings. Processes and issues all accounts payable and subcontractor settlements. Creates regular monthly recaps for Employees Payment and General Obligation insurance coverage premiums. Generates month-to-month Job Expense to Date reports and dealing with PMs to resolve with Project Supervisors' spending plans for each project.

The 45-Second Trick For Pvm Accounting

Effectiveness in Sage 300 Construction and Genuine Estate (previously Sage Timberline Office) and Procore building administration software a plus. https://issuu.com/pvmaccount1ng. Must likewise be competent in various other computer system software systems for the preparation of records, spreadsheets and various other accounting analysis that might be called for by management. construction bookkeeping. Need to have strong organizational skills and capacity to prioritize

They are the economic custodians who ensure that building and construction projects continue to be on budget, conform with tax obligation guidelines, and keep financial transparency. Construction accountants are not just number crunchers; they are calculated partners in the building procedure. Their key duty is to handle the monetary elements of building projects, ensuring that resources are allocated effectively and monetary risks are minimized.

The Single Strategy To Use For Pvm Accounting

By preserving a tight grasp on project funds, accountants assist prevent overspending and monetary problems. Budgeting is a cornerstone of successful building and construction tasks, and building accountants are critical in this regard.

Browsing the complex web of tax obligation regulations in the building sector can be challenging. Building and construction accounting professionals are well-versed in these guidelines and make sure that the project adheres to all tax obligation needs. This includes managing pay-roll tax obligations, sales taxes, and any type of various other tax obligation responsibilities specific to building and construction. To excel in the function of a building and construction accounting professional, people require a solid educational foundation in accounting and financing.

Furthermore, qualifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Market Financial Expert (CCIFP) are extremely concerned in the market. Working as an accountant in the construction industry comes with an unique collection of obstacles. Building and construction tasks commonly involve tight target dates, transforming guidelines, and unforeseen expenses. Accountants need to adapt promptly to these challenges to maintain the project's financial health undamaged.

The smart Trick of Pvm Accounting That Nobody is Discussing

Ans: Building accountants produce and keep an eye on budget plans, determining cost-saving possibilities and making certain that the project remains within spending plan. Ans: Yes, building accounting professionals take care of tax compliance for building and construction jobs.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies have to make difficult options amongst numerous monetary choices, like bidding on one task over another, choosing funding for products or equipment, or setting a job's earnings margin. On top of that, construction is an infamously unstable market with a high failure rate, sluggish time to settlement, and irregular cash flow.

Manufacturing involves repeated procedures with conveniently identifiable expenses. Manufacturing requires different processes, products, and tools with varying expenses. Each job takes area in a new location with differing site problems and one-of-a-kind challenges.

What Does Pvm Accounting Mean?

Durable partnerships with suppliers relieve settlements and enhance effectiveness. Inconsistent. Regular use different specialized professionals and vendors impacts efficiency and capital. No retainage. Settlement shows up completely or with regular payments for the full agreement quantity. Retainage. Some portion of settlement might be withheld until task conclusion even when the specialist's job is ended up.

Normal manufacturing and short-term agreements result in manageable money flow cycles. Uneven. Retainage, slow settlements, and high in advance costs cause long, irregular cash circulation cycles - construction find this bookkeeping. While typical makers have the advantage of controlled settings and enhanced manufacturing processes, building and construction business have to constantly adjust to each new task. Even rather repeatable tasks require alterations due to website problems and other factors.

Report this page